News Global Market semis prices 1680 05 May 2025

Cheap offers of importers do not allow quotes to move to growth

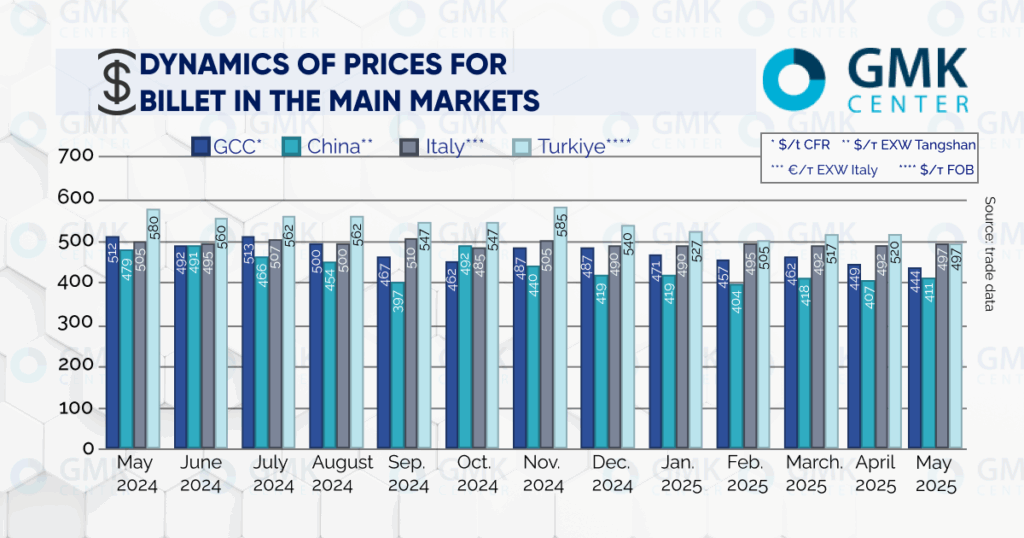

The indicative price of iron steel in the Gulf countries fell from $447/t to $444/t CFR from April 25 to May 2, according to Kallanish. The drop was caused by aggressive marketing by foreign producers.

Thus, during this period, Kuwait recorded offers of Iranian billets at $435/t CFR, and Oman – $440/t CFR. This is much cheaper than local plants. Their requests in Oman amounted to $480-490/t CFR.

With rebar prices falling, re-rollers prefer more favorable offers from foreign billet suppliers. Local producers have to soften their demands to stay in the market. However, they are still losing the competition.

Turkish mills also lowered their prices in an attempt to make their products more attractive. At the end of April, Kardemir, a large steel mill, reduced its billet prices by $15/t compared to the first half of the month to $485/t EXW. It is worth noting that in April, billet offers in Turkey decreased by $33/t to $497/t EXW.

The Middle East region is an important market for Turkish billet producers. Earlier it was expected that in 2025 they would be able to increase sales in Syria due to increased reconstruction work and demand for rebar. However, due to the difficult situation in the country, the reconstruction there continues at a slow pace.

In the Southern European region, the cost of billets has increased by €5/t since mid-April to €497/t EXW as of May 2. The increase in prices is due to the end of the Easter holiday period and the resumption of construction activity. This is expected to allow re-rollers to increase rebar sales.

Chinese quotations for the period from April 17 to 25 rose by $5/t – to $411/t EXW. The price increase was driven by a decline in billet stocks at both producers and traders. At the same time, steel billets in China fell by $7/t over the month.

As reported earlier, the National Bank of Ukraine estimates that in 2025, average prices for steel billets may decline by 5.2% – to $478/t FOB Ukraine. Further, in 2026, prices are expected to rise by 2.9% – to $492/t, and in 2027 – by 2.1%, to $502.5/t FOB Ukraine.