News Global Market iron ore prices 1745 03 June 2025

Weakening steel demand and a general economic slowdown in China weigh on the market

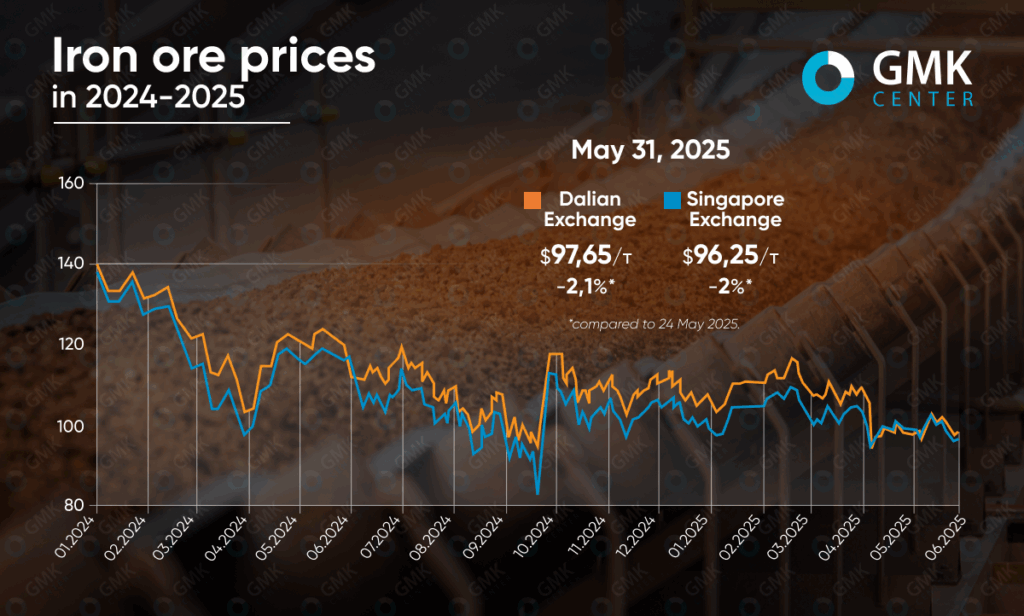

Last week, from May 24 to 31, 2025, global iron ore prices showed a downward trend. On the Dalian Exchange, quotations decreased by 2.1% to $97.65/t, and on the Singapore Exchange by 2% to $96.25/t. This trend was a continuation of the general pressure caused by weakening demand from China, a key player in the iron ore consumption market.

During the week, market sentiment was determined by several key factors. First of all, investors reacted to the decline in demand for steel in China due to the crisis in the construction sector and the overall economic slowdown. A number of Chinese steelmakers are facing losses and are forced to limit production volumes, which in turn reduces demand for ore.

In the middle of the week, rumors about possible new restrictions on steel production in China put additional pressure on the market, further dampening traders’ expectations. An additional factor of uncertainty was the geopolitical situation: the announcement of the reintroduction of higher tariffs in the US on imported steel and aluminum raised concerns about the future prospects for global trade. Although at the end of the week, the news of the temporary blocking of these tariffs by a US court decision brought some improvement in sentiment, it was not enough to offset the overall weekly decline.

As a result, in May, iron ore supply on the Dalian Exchange increased by 0.2%, while in Singapore it decreased by 2.1%, indicating a heterogeneous situation in logistics and demand.

In the near term, the market remains under pressure from macroeconomic uncertainty, and traders expect further volatility. If the situation in the Chinese construction sector does not improve and the expected launch of the large Simandou field in Guinea is not delayed, quotations may decline further. At the same time, the potential for corrections remains on the horizon if the Chinese government resorts to stimulating demand. In the short term, prices are likely to fluctuate in the range of $90-100/t.

As GMK Center reported earlier, Moody’s expects iron ore prices to remain at $80-100/t in the next 12-18 months. This forecast is driven by weak demand from China and high supply on the global market.

A similar view was voiced by BMI Country Risk and Industry Research analysts. They keep the forecast of the average annual price for 2025 at $100/t, although they recognize the pressure from the weak demand.