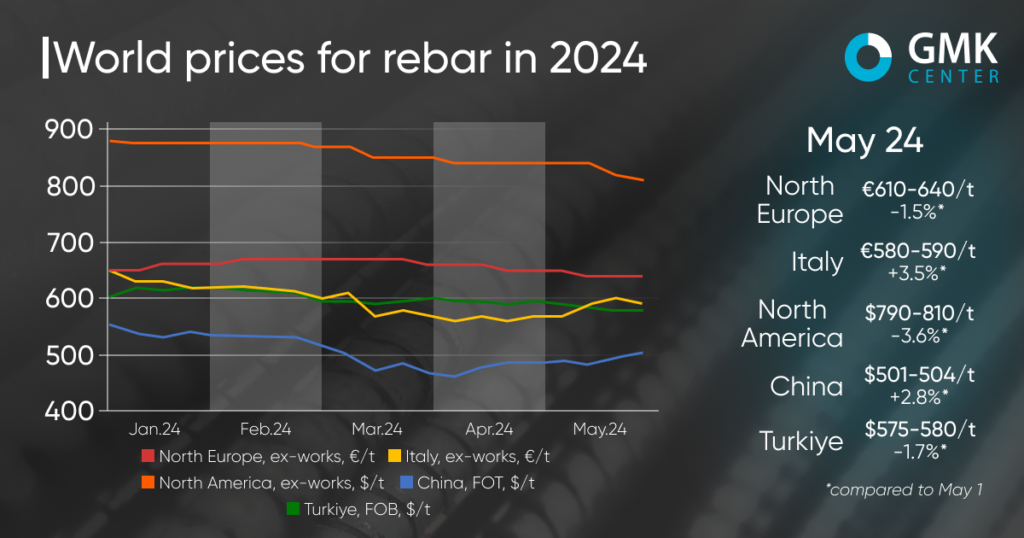

News Global Market rebar prices 3666 31 May 2024

The preponderance of supply over demand restrains trade

Global rebar prices declined in most regions in May. The main factors behind the downward trend were weak demand and a fairly high supply. The state of the construction industry in most countries is not conducive to positive changes in the long products market.

Rebar prices in Turkey in May 2024 decreased by $10/t, or 1.7%, to $575-580/t FOB. In general, prices were mostly stable during the month, with the main adjustment occurring in the first week of the month.

At the end of May, rebar quotations on the Turkish market stopped declining, as the lower price limit increased by $5/t. This was the first slight increase since mid-April. Local producers are testing the market. Almost all mills have set a lower workable price floor of $580/t, but some are willing to consider lower levels depending on order volume.

Rebar sales have seen a slight improvement recently, although they are still insufficient. The main volumes are shipped to Yemen, Romania, Albania and Bosnia. At the same time, Germany, the Netherlands, Spain and Italy have not returned to the market. Expectations of a recovery in demand from European countries at the end of May did not materialize.

Despite the fact that the plants are resisting further price cuts, some market participants believe that the working level is currently $570-575/t for requests for more than 10 thousand tons.

“We won’t see a strong recovery in steel demand that would help Turkish mills increase their utilization until there is an actual reduction in interest rates. The existing sales are far from sufficient for Turkey, given its capacity,” said a local trader.

The slight upward fluctuations in demand, which are quite limited, benefit only scrap suppliers who are seeking to raise prices for raw materials. Turkey’s steel capacity utilization is currently below 50% due to weak end-user demand. Production dynamics are expected to decline as some plants prepare for maintenance. At the same time, some of them are considering shutting down facilities or reducing production during Eid al-Adha in June.

Short-term forecasts are rather negative. It is difficult for producers to find buyers before the holiday and the upcoming summer vacation.

In the European market, rebar prices fluctuated in different directions during May. In particular, in Northern Europe, quotations for the period May 3-24 fell by €10/t, or 1.5%, to €610-640/t Ex-Works. In Italy, prices increased by 3.5%, or €20/t, to €580-590/t.

The downward trend in the European market is caused by a slowdown in construction activity. Manufacturers have to fight for orders in the face of fierce competition. Some large companies, having financial reserves, lower prices to uncompetitive levels to fill their order books. This puts small producers in a bind, as they are unable to handle large orders and have no financial cushion to deal with losses.

Meanwhile, in the Italian market, producers managed to raise prices slightly amid rising consumer activity after the holidays in late April and early May. During this period, local steelmakers cut production to balance supply and demand, which yielded a visible result. In addition, rebar prices were supported by rising scrap prices.

As March was quite quiet for the Italian rebar market, sales resumed in late April. This helped prices recover. Demand from the construction industry is still insufficient to sustain this trend, so in the short term, rebar prices are expected to stabilize or decline in the Italian market.

In the North American region, rebar prices in May fell by $30/t, or 3.6%, to $790-810/t Ex-Works. The main reason for the decline in prices is weakening demand in the face of sufficient supply. In addition, lower scrap prices put additional pressure on finished product prices.

“Weak demand, construction work is not developing at the expected pace. Funds for infrastructure projects are coming in slowly. Flat products, bars, rebar – there is low demand for all types of structural steel and more than enough supply,” the distributor points out.

In the short term, prices are expected to decline further until scrap prices start to rise.

In China, rebar prices rose by $14/t in May – to $501-504/t FOT. At the beginning of the month, trends in the Chinese rebar market were disappointing. Prices were falling due to weaker demand and sufficient supply. However, since the second decade of May, market sentiment has improved on the back of government incentives for the real estate market and interest rate cuts by the Chinese Central Bank. Some of the major metallurgical companies reported an increase in supply by the end of May.