News Global Market steel market 1362 20 March 2025

Protective measures were the main factor behind the rise in product prices in the US and EU

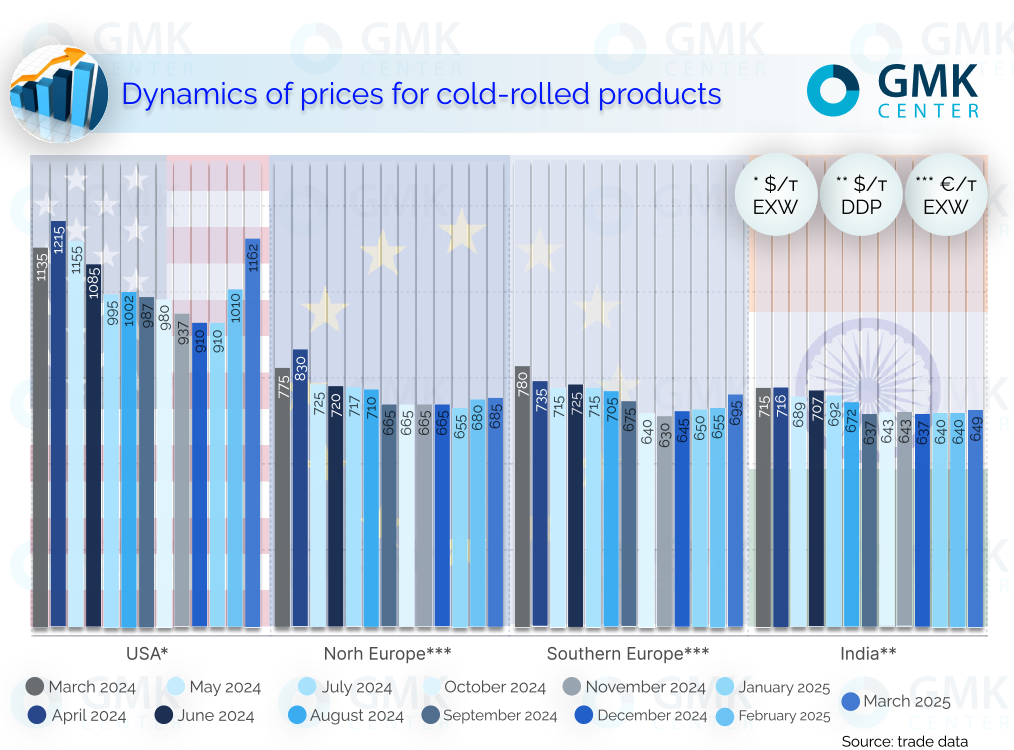

The price of cold rolled coil in North America increased from $1,125/t EXW as of February 28 to $1,162/t EXW as of March 20, according to Kallanish. The rise in product prices is not supported by the growth of domestic demand.

The American auto industry, the main consumer, showed a decrease in production in February. According to S&P Globals, new car sales in the US amounted to 1.23 million units. This is 100 thousand units less than a year earlier.

This means that the driver of price growth was a decrease in supply due to a reduction in imports. As is known, since March 4, the US has been levying an additional 25% duty on the import of all types of metal products. Nevertheless, S&P Globals believes in the growth of the American auto market in 2025 to 16.1 million units. against 15.6 million units in 2024. February auto sales volumes allow reaching the target figure for the year, according to the agency’s analysts. Prospects for growth in demand for cold-rolled products in the US remain.

In Northern Europe, cold-rolled coils rose in price by €5/t in the first week of March, to €685/t EXW, after which they stopped at this level. Prices grew faster in Southern Europe, from €675/t to €695/t EXW Italy as of March 20.

In January, new car sales in the EU fell by 2.6% year-on-year, according to the Association of European Automobile Manufacturers (ACEA). The decline was recorded in the main markets, Germany and France. The increase in the cost of cold-rolled products is associated with the tightening of quotas for duty-free imports, which the European Commission announced in March.

Indian cold-rolled coil prices rose to $649/t DDP from $640/t in March. Auto sales in India rose 1.6% y/y to 3.993 million units in January, a record high, according to SIAM. The rise in local cold-rolled coil prices was driven by strong demand from automakers.

It was reported that flat-rolled coil imports to the EU could decline by 25% in Q2 2025 compared to Q1. This would mean a reduction in supplies of about 2 million tonnes, according to World Steel Dynamics.