News Global Market Australia 6546 20 March 2024

Demand for raw materials in the Asian market remains weak

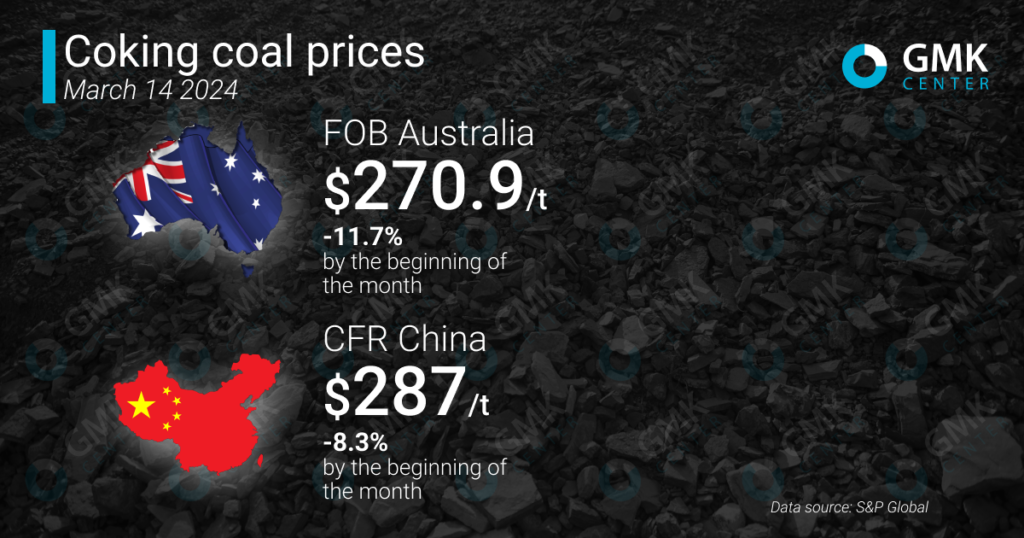

According to S&P Global, Australian coking coal quotations (FOB Australia) fell by 11.7% over two weeks in March (March 1-14) to $270.9/t compared to the beginning of the month.

As of March 14, coking coal in China (CFR China) was offered at $287/t, while raw material quotations fell by 8.3% compared to the beginning of March.

On the Singapore Exchange, April futures for premium coking coal settled at $254/t FOB on March 15, down $33/t from a week earlier.

Prices for coking coal

Prices for premium coking coal from Australia fell last week amid lack of demand, while suppliers tried to boost sales by actively making offers to end users.

Australian investment bank Macquarie predicts the average price for hard coking coal (HCC) at $300/t by the end of this year. Analysts explain this by a weaker market compared to last year, mainly due to improved supply in the near term. Macquarie also expects coal supplies from Australia to increase to 160 million tons this year.

The Chinese market remained subdued as local coke producers recently passed the fifth round of price cuts for their products, with a sixth round expected in the future. They are now slowly weighing the prospect of cutting production and maintaining low inventories. However, in January-February, according to the National Bureau of Statistics, coke production in China increased by 2.1% year-on-year to 80.39 million tons.

In March, China’s coking coal and coke production fell due to weak steel demand and a decline in pig iron production for the fourth consecutive month. At the beginning of last week, significant volumes of these raw materials remained unsold. Australian imports, despite falling prices, are still quite expensive for Chinese buyers.

In early March, China’s largest coking coal producer, Shanxi Coking Coal Energy Group, called on the state to control the supply of this product, limit production and consolidate small producers into state-owned firms to «reduce disorderly competition,» Bloomberg reports. Zhao Jianjie, the company’s chairman, told local media. In his opinion, China should also create strategic reserves of this raw material.

According to him, while the country has a large amount of thermal coal, metallurgical coal reserves are much smaller, which has led to overdependence on imports and created vulnerabilities.

In recent months, coking coal producers have been heavily impacted by a series of mine emergencies, which have led to production stoppages and supply constraints. The prolonged downturn in the real estate market is also reducing demand for this raw material from steel mills.

At the same time, Indian buyers have taken a wait-and-see attitude, hoping for further price declines, which traders believe could revive their buying interest. According to one of the sources of S&P Global, a steel producer, weakness in the local coking coal market will continue until June, as steel demand will be lower until after the general election in the country. Coke producers have high levels of raw material inventories amid declining demand for their products, which has led them to reduce purchasing activity.

In late 2023 and early January 2024, coking coal prices in Australia rose as the market experienced increased demand for Australian raw materials due to problems in the Red Sea that caused delays in the supply of raw materials from the United States. At the same time, the country’s mining companies were uncertain about possible supply volumes in January and February. In the second half of January, commodity prices still declined due to lower demand and market weakness.