News Global Market gas prices 2835 24 April 2025

Low rates of injection into underground storage facilities and reduced consumption in industry acted as constraints

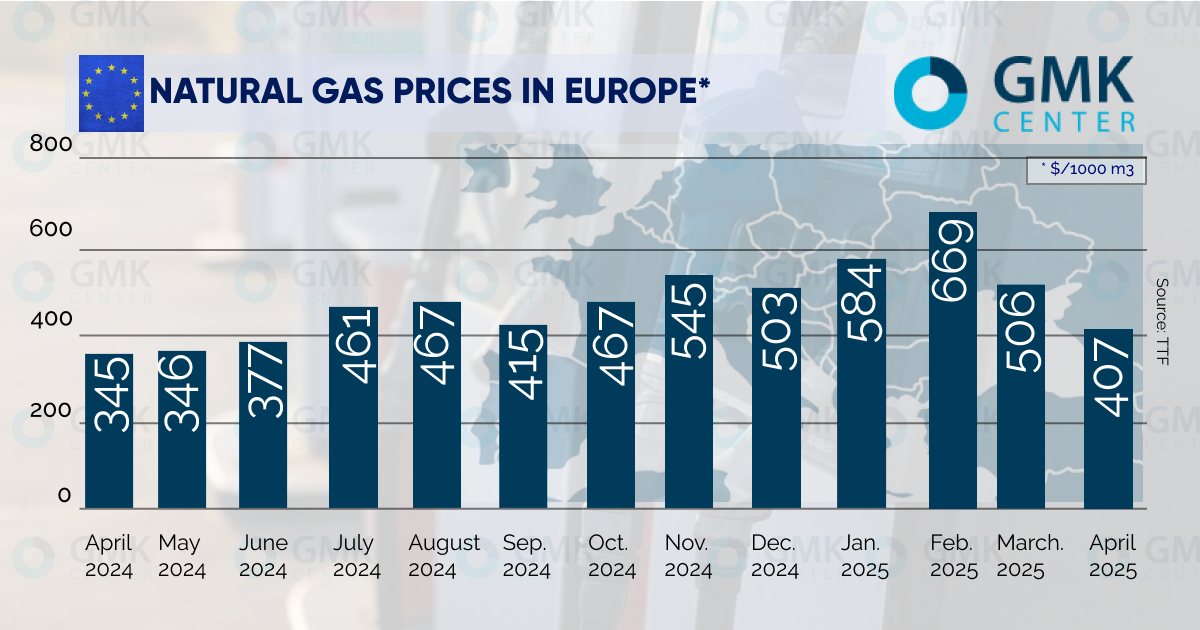

From April 17 to April 23, spot gas quotations on the Dutch TTF exchange dropped from €375/1000 m3 to €358/1000 m3. Thus, the supply returned to the level of the middle of the month. The slight increase at the end of last week was caused by an emergency shutdown at one of the Norwegian offshore fields.

Gas traders are in no hurry to accumulate stocks in underground storage facilities (UGS). According to AGSI+, the occupancy rate of European UGS facilities increased to 36.4% as of April 18, compared to 34.6% as of April 4. The absence of active injection reduces demand, restraining price growth.

At the same time, gas consumption in industry declined as a result of a general cooling due to US tariff initiatives, particularly against the EU. In January-March, steel production in the European Union decreased by 2.5% y/y – to 32.4 million tons. At the same time, the decline stopped in March, with a year-on-year increase of 0.2% to 11.7 million tons.

The downward trend is facilitated by the expansion of the supply of liquefied natural gas (LNG) to the EU from the United States. On April 15, one of the largest players, Venture Global, launched the second phase of the Calcasieu Pass plant in Louisiana with a capacity of 2 million tons of LNG per year.

From April 14 to April 23, spot gas quotations on the NYMEX exchange decreased by $15 to $109/1000 m3. In the first half of April, stocks in US UGS facilities increased by 45 million m3 to 52.27 billion m3. As in the European region, injections immediately after the end of the heating season are characterized by low rates.

Gas consumption in industry is also showing a decline. US steel production in the first quarter decreased by 0.6% y/y – to 19.7 million tons. At the same time, the decline accelerated to 1.5% in March, with production amounting to 6.7 million tons. The combination of these factors is pushing down spot gas prices.

Asian JKM LNG prices rose from $394/1000 m3 to $429/1000 m3 from April 14 to April 17, according to the Tokyo Mercantile Exchange. The rise in price is due to emergency stoppages of shipments at a number of terminals, including Malaysia’s Bintulu.

As reported, in February, seasonally adjusted industrial production in the European Union increased by 1% compared to the previous month. In the euro area, the figure increased by 1.2% m/m. Compared to February 2024, industrial production in the euro area grew by 1.2% and in the EU by 0.6%.