News Global Market Europe 1157 09 November 2023

Steel processing plants have been experiencing losses for several months

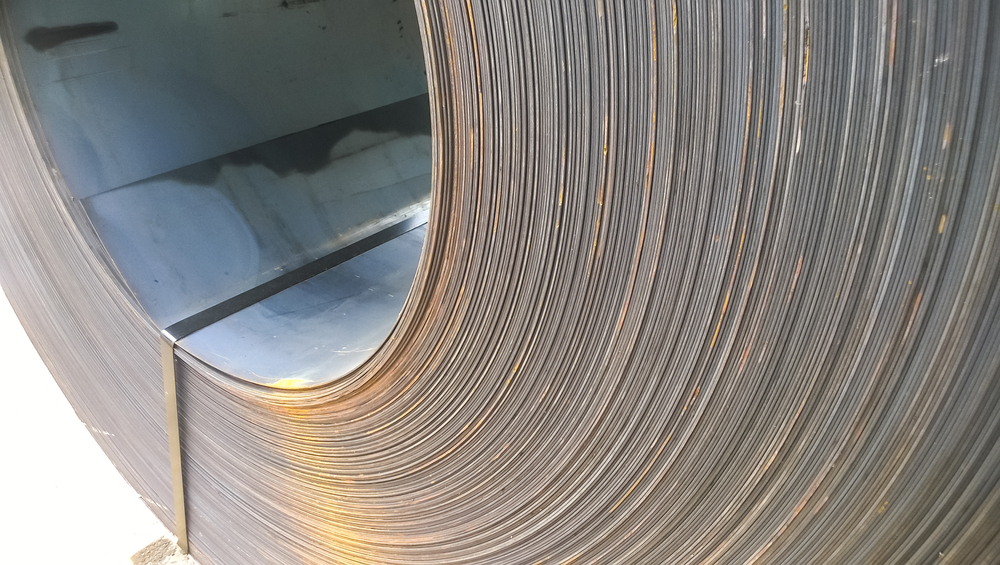

European steel mills do not have the opportunity to reduce contract prices for rolled steel for January-June 2024. Producers announced this at an industry exhibition in Germany, writes Argus.Media.

While both factories and buyers recognize that demand is weak, they agree that margins have bottomed out. The point is that producers have been making losses for several months now and can no longer afford to do so, as they have told buyers.

Contract offers for the first half of 2024 were made at the level of July-December 2023 – €750-800/t, sources say. Some factories have already proposed an increase, but their intention is obviously to ensure that prices are prolonged. One large European producer said it would not enter into negotiations until buyers realize that a price reduction is impossible. However, he agrees with the view that growth is unlikely given the low demand.

Spot indices are not a benchmark for longer-term contracts for higher value-added products, a source at one of the steel mills said. At the same time, mills are making efforts to support spot prices, trying to bring the spread closer to the contractual levels they want to achieve.

After months of stockpiling, service centers are also ready to raise prices, although they have doubts about how much they will be able to pass them on to customers.

Steel mills also hint at the threat of dumping investigations against foreign producers, especially Asian ones. The producers point out that they sell their products in the EU below cost, despite having a lower cost base than European companies. In July of this year, more than 70% of the EU hot-rolled coil import market was supplied from Asia. The share of Vietnam was almost 25%, Taiwan 14% and Japan 13%.

As GMK Center repored earlier, in early November, ArcelorMittal informed its customers of its intention to raise the price of hot rolled coil (HRC) for January orders to €680/t ex-works Northern Europe. European integrated steel mills in Northern Europe are becoming increasingly assertive and are seeking to raise their offer prices for coil for January delivery by €30-50/t. They cite rising costs and limited product availability due to production cuts.