News Global Market EU 2907 29 February 2024

In December, deliveries of Ukrainian products to the EU amounted to 92.64 thousand tons

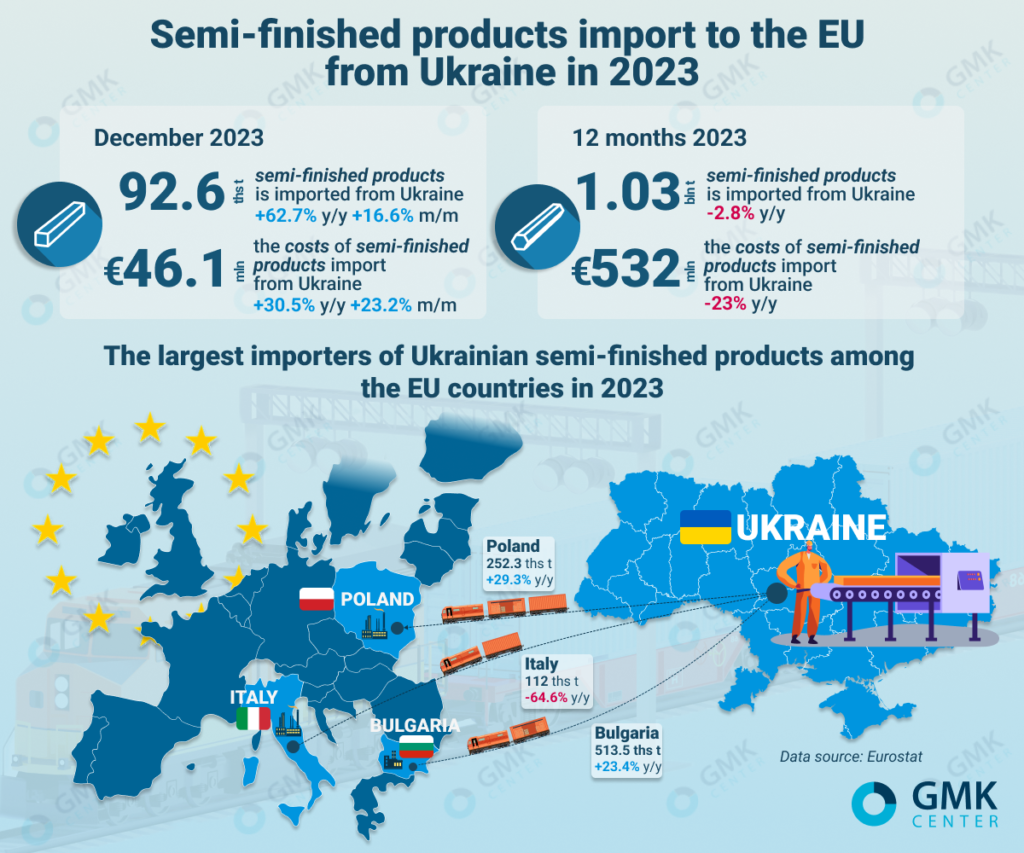

In 2023, the European Union (EU) reduced imports of semi-finished products from Ukraine by 2.8% compared to 2022, to 1.03 million tons. Imports in monetary terms decreased by 23% y/y – to $531 million. This is evidenced by Eurostat data.

The largest importers of semi-finished products of Ukrainian origin among the EU countries in 2023 were:

- Poland – 252.3 thousand tons (+29.3% compared to 2022);

- Bulgaria – 513.5 thousand tons (+23.4% y/y);

- Italy – 112 thousand tons (-64.6% y/y).

In December, imports of semi-finished products from Ukraine amounted to 92.64 thousand tons, up 16.6% month-on-month and 62.7% y/y. Import costs increased by 23.2% mom and 30.5% yoy to $46.1 mln. Poland consumed 11.3 thsd tonnes (+56.3% m/m) of the product, Bulgaria – 57.3 thsd tonnes (+1.9% m/m), and Italy – 10.4 thsd tonnes (-13.9% m/m).

In 2023, Ukraine reduced exports of semi-finished products by 36.7% compared to 2022, to 1.203 million tons. Compared to the pre-war year 2021, shipments of semi-finished products abroad decreased by 82.2%, or 5.57 million tons. Revenues of domestic enterprises from the export of semi-finished products last year decreased by 48.9% compared to 2022, to $608.52 million.

The largest consumers of Ukrainian-made semi-finished products in 2023 were Bulgaria – 36.7%, Poland – 23%, and Italy – 9.6%.

In 2023, Ukrainian steelmaking companies continued to operate in the face of limited logistics capabilities and unfavorable global market conditions. The main Ukrainian steel companies, Metinvest Group’s enterprises (Kametstal and Zaporizhstal) and ArcelorMittal Kryvyi Rih, operated last year at capacity utilization rates of 65-75% and 20-30%, respectively.