News Global Market iron ore prices 2894 26 May 2025

Despite the positive news, the market remained without clear dynamics

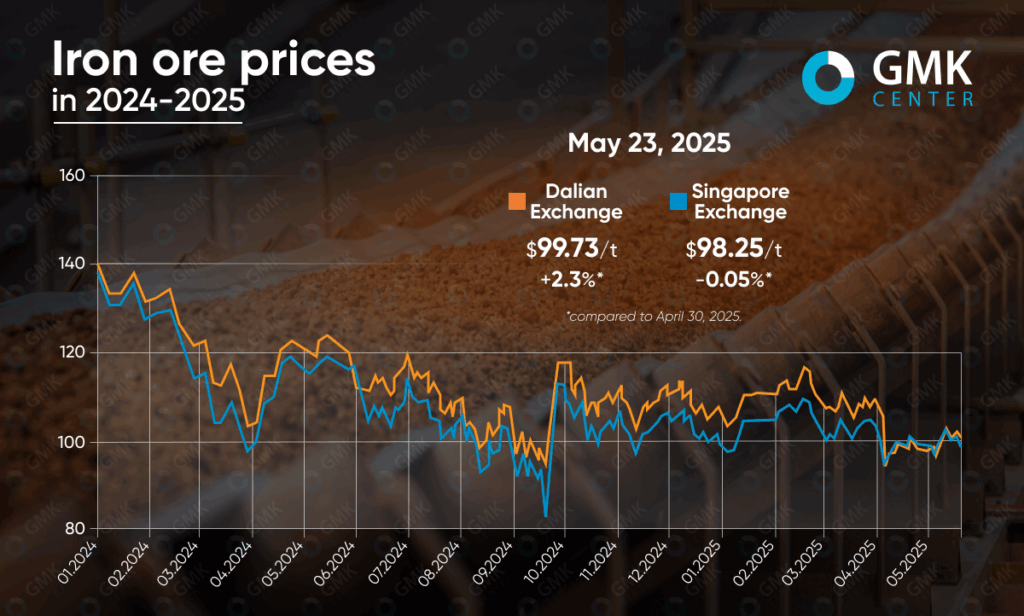

In May 2025, the iron ore market showed limited volatility, remaining mostly within a narrow price range. As of May 23, 2025, iron ore futures on the Dalian Exchange increased by 2.2% since the beginning of the month to $99.73/t, although they have declined by 2.3% over the past week. On the Singapore Exchange, quotes slightly lost value to $98.25/t (-0.05% for the month; -3.1% for the week).

Despite the relative stability of prices, the market was under pressure from conflicting factors. On the one hand, demand from Chinese steelmakers remained subdued, driven by a weak recovery in the construction sector and sluggish macroeconomic indicators in China. Investors’ expectations were particularly negatively affected by data on a slowdown in industrial production and weak credit indicators released in the middle of the month.

On the other hand, the market was supported by hopes for foreign economic improvement. Amid news of progress in trade negotiations between the US and China (May 13-15), prices reached their highest levels in more than five weeks. Another positive factor was the decline in the US dollar, which made ore imports more profitable for Asian buyers.

However, the potential for growth was limited. Concerns about the reduction in steel production in China (which has been going on since April), as well as the growth of ore supplies by key producers (Australia and Brazil), restrained market optimism. Analysts also note that activity on the stock exchanges remained low, as traders cautiously assessed the balance between stable demand and the risk of oversupply.

In the short term, iron ore prices are likely to remain in a narrow range of $95-105/t. Further dynamics will depend on macroeconomic signals from China – primarily from the construction sector – and the progress of trade negotiations with the US. In the event of new incentives from Beijing or a significant weakening of the dollar, a moderate increase in quotations is possible. At the same time, the risks of lower demand and rising inventories remain a pressure factor.

As GMK Center reported earlier, Moody’s expects iron ore prices to remain at $80-100/t in the next 12-18 months. This forecast is driven by weak demand from China and high supply on the global market.

A similar view was voiced by BMI Country Risk and Industry Research analysts. They keep the forecast of the average annual price for 2025 at $100/t, although they recognize the pressure from the weak demand.