News Global Market pig iron prices 1259 05 June 2025

Negative dynamics is related to US import tariffs and tax changes in Brazil

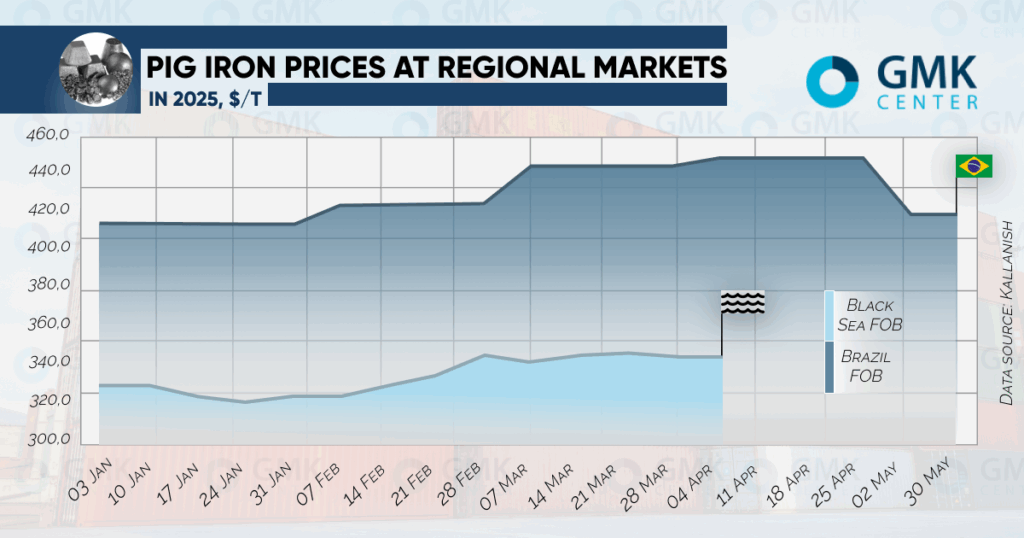

For January-April 2025, average FOB Brazilian pig iron prices increased from $415/t to $450/t, but subsequently declined to $420/t in May. The decline in prices was due to the tightening of US import duties and a change in Brazil’s financial transaction tax rate, which is limiting trading activity. According to Platts, prices are now in the range of $415-430/t FOB.

Brazilian pig iron prices could fall further if competition from Canada, to which US duties do not apply, increases. In addition, the U.S. market is experiencing a seasonal abundance of scrap, the dynamics of prices for which indirectly affect the price of pig iron.

According to Kallanish, pig iron exports from Brazil in April compared to March increased by 5% to 367.6 thousand tons. Almost 90%, or 329 thousand tons were shipped to the US at $409/t. At the same time, pig iron production in April decreased by 10.3% to 2.1 million tons compared to March.

In January-March, Turkey’s pig iron imports decreased by 1.6% y/y. – As SteelOrbis reports, the largest supplier was Russia, which supplied 66%, or 295.4 thousand tons (-13.8% YoY). The share of imports from Russia is probably even higher, as 68,000 tons of pig iron from Kazakhstan could actually be of Russian origin.

European buyers have already exhausted the quota of 700 ths tons of Russian pig iron imports to the EU. The largest importers were Italy (525 thousand tons), Latvia (87 thousand tons) and Belgium (31 thousand tons). It should be reminded that from 2026 the supply of Russian pig iron to the EU should be completely stopped.

Due to the lack of Russian pig iron, other suppliers will be able to increase supplies, but it is likely that the cost of imports will increase. FOB Black Sea pig iron prices do not exceed $350/t, while Brazilian pig iron is shipped at around $420/t. The appearance of Russian pig iron on the European market under a different “flag” cannot be ruled out.

As previously reported, global pig iron production in January-April 2025 increased by 0.08% y/y – to 463.6 million tons. The largest producers of pig iron for this period were China – 288.8 million tons (+0.8% y/y), India – 50.7 million tons (+7% y/y) and Russia – 20.1 million tons (+0.1% y/y).

Recall that at the end of January-April, the volume of pig iron exports from Ukraine increased by 37.4% y/y – to 574.1 thousand tons. The USA accounted for 476,000 tons (+46.7% y/y) of shipments, Italy – 65,500 tons (+106.7% y/y), Poland – 14,500 tons (-27.3% y/y).