News Global Market slabs 499 26 May 2025

Asian suppliers have entered the U.S. market, but their supply is unlikely to be sustainable in the future

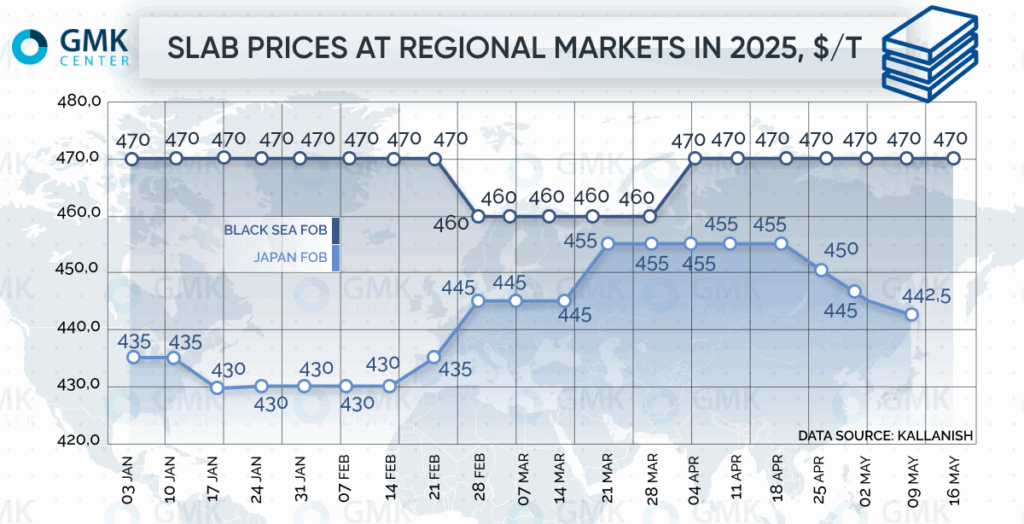

Regional markets are experiencing multidirectional dynamics of slab prices. Russian dumping, hot rolled coil (HRC) prices and US tariff policy remain the key influencing factors.

Slab prices FOB Black Sea have been in the range of $430-455/t since the beginning of the year. Within four weeks since mid-February they have increased by $15/t. The second stage of increase was observed from the middle of March, when prices rose by another $10/t. Such price dynamics fully coincides with FOB Turkey, i.e. growth of slab prices was supported by growth of prices for finished products.

According to Steelorbis, the latest offers for Chinese slabs in Europe are $510-515/t CFR, which is $10-15/t lower than in early May. Prices for slabs from Russia and Asian slabs for HRC production are $480-485/t CFR, down from $500/t CFR in early May.

Turkey remains the largest consumer of slabs from Russia. In January-March, imports of Russian slabs to Turkey increased 2.5 times y/y – up to 443.5 thousand tons. This significant growth is due to short logistic shoulder and lower prices compared to other suppliers. The price of slabs from the Russian plant, which is under trade sanctions in other regions, is $450-455/t CFR, while from a supplier not included in the sanctions lists – $470-475/t CFR Turkey. Therefore, Turkish HRC producers find such imports attractive in terms of reducing their own production costs.

According to Steelorbis, prices for slabs from Asia in May fluctuated in a narrow range with slight discounts due to weak demand from European buyers. August offers from Indonesia are $440/t FOB as of May 22, the same level as early May. Asian slabs have even appeared on the US market, but this is unlikely to be a trend due to existing tariffs.

According to Steelorbis, Brazilian slab prices have been at $510/t FOB for the past three weeks. At the same time, individual US buyers started buying Asian products to have more arguments in negotiations with suppliers from Brazil, which is in a priority position due to the exemption from the 25% tariff.

Slab prices in Japan are quoted at $460-470/t, having slipped to the lower end of the range during March. As of mid-May quotations were at $470/t FOB.