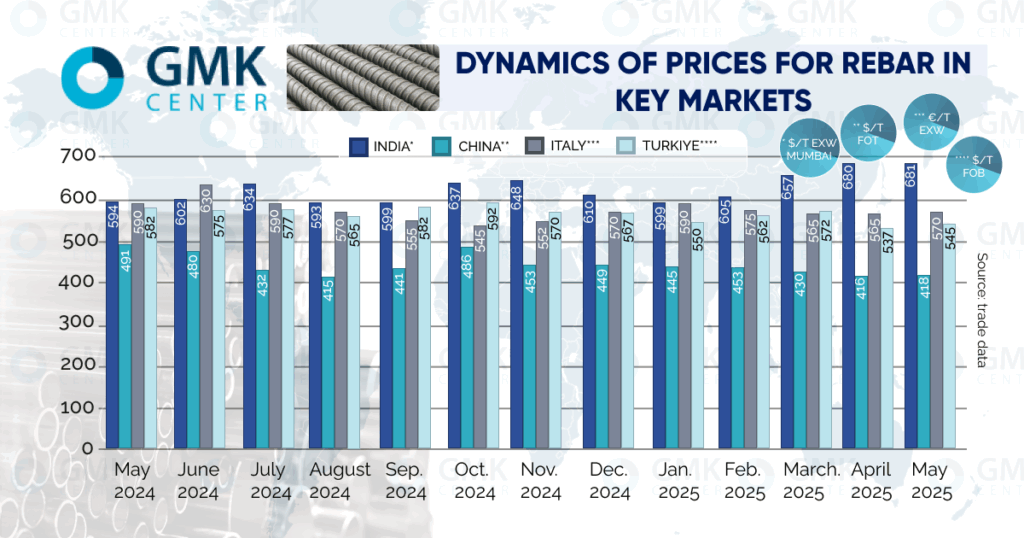

News Global Market rebar prices 2034 12 May 2025

Production stoppage at a number of large steel mills did not support the quotes

Offers for rebar in India fell from $689/t to $681/t EXW Mumbai for the period from May 2 to May 9, according to Kallanish. The market is adjusting after the government imposed a 12% tariff on imports of rolled steel.

When this measure was being discussed, construction companies were actively purchasing rebar in stock. They were afraid of a sharp rise in prices after the tariff was imposed. Currently, these stocks allow them to refrain from new purchases.

It is worth noting that a number of major producers shut down their long-range rolling mills for repairs in late April. These include Tata Steel, SAIL and JSW Steel. This reduced the supply of rebar to the market. However, prices still fell.

At the same time, demand for steel products in India remains strong thanks to government support. In particular, since April 1, the country has had an updated Steel Products Policy approved by the government.

The document provides for the priority of locally produced finished steel over imported steel in public procurement over $5.9 thousand. At the same time, companies from countries where governments restrict the access of Indian steel mills to their public procurement are not allowed to participate in tenders.

Italian rebar quotations from May 2 to May 9 fell by €5/t – to €570/t EXW.

In Turkey, from May 1 to May 7, requests from rebar producers increased by $5/t to $545/t FOB. In the first decade of May, Kardemir, a large steel mill, raised prices by $7.7/t to $542/t EXW. Other plants followed suit. This way, they are trying to compensate for the increased cost of scrap. But domestic demand for rebar remains weak.

In China, spot rebar prices fell by $6/t to $418/t FOT from May 2 to 9. Traders and consumers now have large stocks, so purchases are made as a last resort. Significant price increases are not expected. On the Shanghai Exchange ShFE, futures for rebar delivery in October last week were trading at $424/t.

As reported, the China Steel and Iron Association (CISA) is initiating the creation of a new steel capacity management system. It will combine state supervision, industry self-regulation and market principles.