News Global Market rebar prices 1718 16 April 2025

The jump in quotations at the beginning of the new fiscal year reflects the optimism of market participants

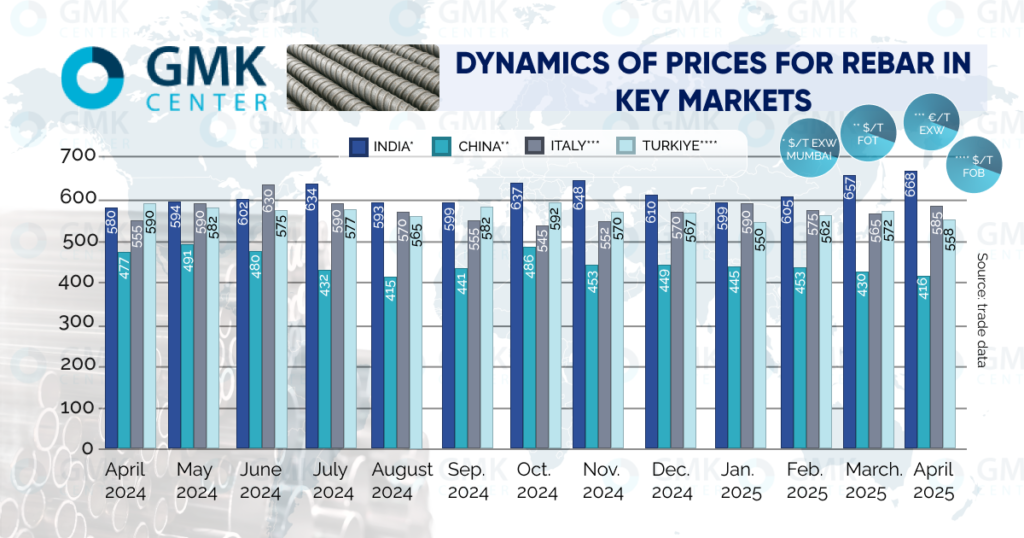

The cost of rebar in India remained stable at $668/t EXW Mumbai for the period April 4-11, according to Kallanish. At the same time, since the beginning of the month, the price has risen by $12/t. Metal traders expect prices to rise further in the next few weeks.

The forecast is based on confidence in the strength of demand for rebar and structural shapes from local construction companies. As before, government orders remain the main driver of the construction market in India. Therefore, demand will be supported by government funding.

For the 2025-2026 fiscal year (started on April 1), the Indian government has budgeted a 10% increase in public direct investment to $130.6 billion. At the same time, the Minister of Construction and Urban Development of India Hardeep Singh Puri announced an increase in investments in infrastructure projects in 2024-2028 fiscal years by 1.78 times compared to 2020-2024 fiscal years.

In Italy, rebar quotations increased by €20/t to €585/t EXW from April 1 to April 11. Local producers refuse to reduce prices at the request of a few buyers. Traders attribute the sluggish demand for rolled construction products to the Easter holidays.

Meanwhile, in Turkey, rebar offers lost $14/t from April 1 to April 12, falling to $558/t FOB. According to market participants, local construction companies and importers in the Southern European region are not ready to buy Turkish rebar. This is because their competitors from Algeria and Egypt offer products at lower prices.

In China, rebar fell by $12/t in the period from April 1 to April 11, to $416/t FOT. Market participants believe that this is a situational factor caused by uncertainty about the future prospects of Chinese steel exports in the context of the trade war with the United States.

Rebar quotations for futures contracts for October delivery on the Shanghai Stock Exchange decreased by $14/t to $429/t from April 1 to April 11. However, offers on such terms remain higher than current spot prices.

Housing construction in China continues to plunge into crisis and cannot support demand for rebar. According to Fitch, in 2025, sales of new housing in China will fall by 10% due to many completed projects with no buyers. This means that further construction makes no sense.

Negative trends in the housing sector are offset by encouraging dynamics in infrastructure construction. According to the General Bureau of Statistics of China, investments in this sector grew by 5.6% in January-February.

As reported, State Grid Corp. of China, China’s largest power grid operator, plans to increase investments to a record $89 billion in 2025, up 8.3% from a year earlier.