News Global Market India 3696 04 October 2024

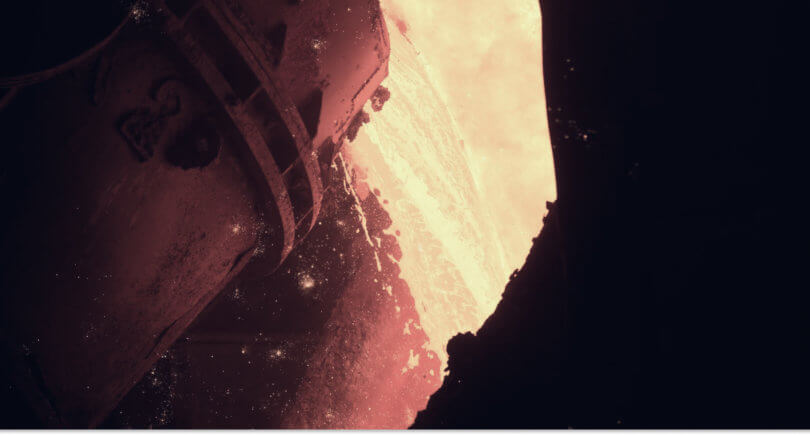

Country's steel companies have good positions in the global steel sector

India’s steel industry will add about 23 million tons of steel production capacity during the fiscal years 2023/2024 – 2026/2027. This is stated in an industry report by international brokerage Nomura, The Economic Times reports.

The compound annual growth rate (CAGR) is expected to be 4.8%, which corresponds to the long-term average growth for the 2014/2015 – 2023/2024 financial years.

According to analysts, Indian steel companies such as JSW Steel, Jindal Steel and Power (JSPL), Tata Steel and ArcelorMittal Nippon Steel (AMNS) are expected to account for almost 87% of the current capacity expansion in India.

Nomura predicts that despite the significant capacity growth, demand will outstrip supply, improving their internal balance sheet and reducing their dependence on exports.

According to analysts, Indian steel companies are well positioned in the global steel sector. They benefit from operating at the lower end of the global cost curve, mainly due to lower labor costs. In addition, the cost of iron ore in the country remains competitive compared to other countries, even for non-integrated steel producers.

Future expansion in the Indian steel sector is expected to come mainly from new projects, with existing capacity being expanded or modernized. Strong domestic demand is another factor that could help reduce the industry’s dependence on exports.

According to BigMint’s forecast, by the end of FY2024/2025 (ending in March 2025), steel production in India will grow by almost 6% y/y – to 152 million tons. The main contribution to the projected volumes in the current fiscal year should come from steel mills operating blast furnaces. Their expansion plans were developed long before the issue of decarbonization became a global concern.