News Global Market hot-rolled prices 1206 17 June 2025

Quotations for welded pipes in Turkey have also fallen by $20/t since mid-May

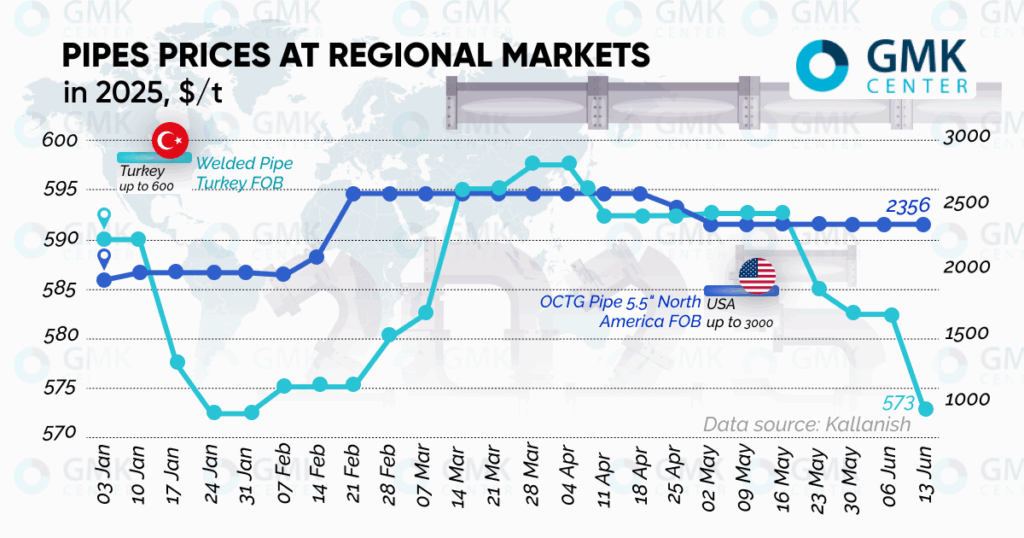

Since the beginning of the year, average prices for OCTG pipes (5.5 inches) on North America FOB terms have risen from $1,940/ton to $2,356/ton. During this period, their dynamics were heavily influenced by expectations regarding Donald Trump’s “Drill, baby, drill” policy.

This policy implied active support for oil and gas production in the US, including the relaxation of environmental regulations, permission to drill in the Arctic National Wildlife Refuge, the lifting of restrictions on hydraulic fracturing, and support for the construction of pipelines (e.g., Keystone XL). According to Kallanish, in anticipation of growing demand, prices for OCTG pipes jumped 34% to $2,590/ton by mid-February.

However, Trump’s inconsistent and chaotic tariff policy and mirror measures by other countries led to fears of a slowdown in global economic growth, which negatively affected oil prices. In addition, this was compounded by geopolitical de-escalation in the spring and increased supply from OPEC+ and other oil-producing countries. As a result, from January to early April, the price of WTI fell by almost 25%, from $80 to just under $60 per barrel. All this led to a 9% decline in OCTG pipe prices in May, to $2,356/t.

The price trend for OCTG pipes on the US market correlates not only with the price of oil, but also with the number of oil and gas rigs in the US. In January, the number of rigs in the US fell by seven to 582. In February and March, there was a predicted increase of eight and two rigs, respectively. In April, there was a “thaw” – a decrease of six rigs. As of June 13, US companies had reduced the number of active drilling rigs to the lowest level since November 2021 – to 555.

According to Kallanish, prices for welded pipes on Turkey FOB terms in the first half of 2025 were quite volatile, although the level of fluctuations did not exceed $15-20/t. The first price decline of $15/t was observed from the second decade of January to the third week of February. Then, until the beginning of April, there was an increase to $598/t. From that moment until mid-June, prices for welded pipes declined and reached $573/t.

This price trend is fully consistent with the dynamics of hot-rolled coil prices on Turkey FOB terms. At the beginning of the year, coil prices fell by $15/t due to weak demand caused by low activity after the New Year. It was only in February that the hot-rolled coil market began to improve amid growing demand. The second stage of price declines in April-June – twice by $15-20/t – was caused by unstable demand and the dominance of cheap imports from Asia, which producers chose to combat by adjusting their prices.

It should be noted that Interpipe is expanding its presence in foreign markets. The company has manufactured pipes for the first time for use underwater in shallow waters for the South Akçakoca Sub-Basin (SASB) gas field in the Black Sea. Interpipe has also begun supplying 127 mm diameter casing pipes to Italy, where the products will be used in the salt industry.