News Global Market ferroalloys prices 1596 07 May 2025

Reduction in production costs influenced the demands of factories

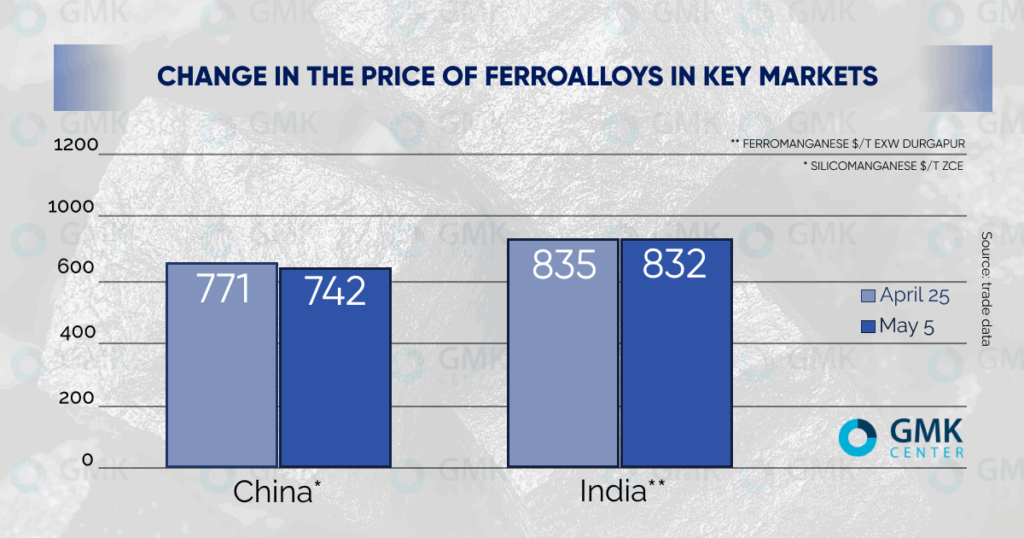

Quotes for Indian ferromanganese (Mn 70) fell by $8/t from April 25 to May 5 to $863/t EXW Durgapur, according to BigMint. Offers for ferromanganese (Mn 75) decreased by $9/t to $865/t EXW.

Domestic prices for Indian silicomanganese (Mn 60) decreased by $3/t to $831-834/t EXW Durgapur. Export quotations fell by $2/t – to $840/t FOB for (Mn 60). For Mn 65 – by $1/t, to $931/t FOB.

The dynamics were affected by a decrease in the cost of raw materials. India’s largest producer MOIL reduced its manganese ore prices on May 1. For Mn 44 – by 5%, for Mn 30 – by 10%, for Mn 25 – by 15%.

Imported resources have also fallen in price. The cost of South African manganese ore decreased by 5% – to $3.92/t CIF India for Mn 37 from April 25 to May 5, and Australian ore by 4% – to $4.92/t CIF India for Mn 46.

In addition, spot electricity in India fell from $72/MWh to $60/MWh during the review period, according to IEX. Lower production costs allowed ferroalloy plants to reduce their price requests.

Steel companies benefit from this situation. Their costs for ferroalloys are reduced. At the same time, Indian prices for finished steel have been growing steadily this year. We can expect further price increases due to strong demand. CRISIL predicts that steel demand in India will grow by 8-9% in 2025.

Chinese spot prices for ferrosilicon (Si 75) remained at $858/t EXW from April 25 to May 5. At the same time, futures for July delivery fell by $29/t to $742/t, according to the ZCE exchange on May 6. This reflects traders’ distrust of the effectiveness of government incentives in China’s steel industry.

As reported, India plans to increase its steelmaking capacity to 500 million tons per year by 2047. At the same time, the export potential will reach 25 million tons per year. The relevant concept was presented by Prime Minister Narendra Modi.