News Global Market hot-rolled prices 4843 29 May 2024

Producers intend to reduce production

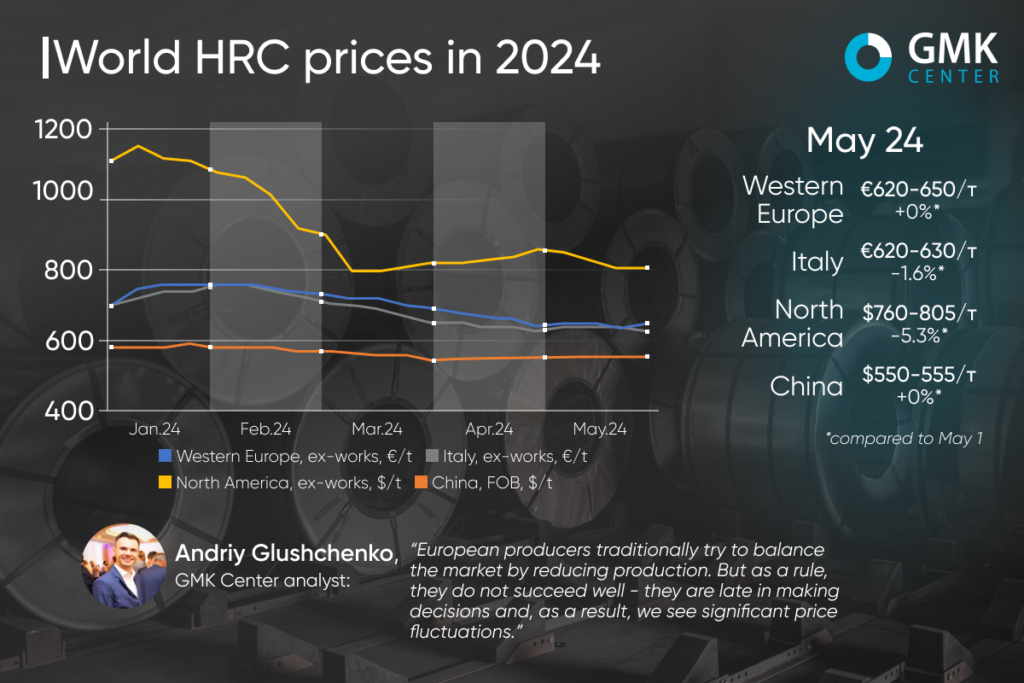

In May 2024, prices for hot-rolled coils fell in most major markets. Trade is constrained by an excess of supply over demand, unfavorable economic prospects and uncertainty in the steel market.

Hot-rolled steel prices in Western Europe remained stable in May. In particular, as of May 24, 2024, product quotations amounted to €620-650 per tonne Ex-Works compared to €630-650 per tonne Ex-Works on May 3. That is, only the lower price limit has decreased. On the Italian market, HRC prices fell by 1.6% to €620-630 per tonne during May 3-24.

At the beginning of the month, European hot-rolled coil producers were considering a possible price increase amid stabilizing supply from Asian suppliers. Only Italian mills managed to realize their intentions, with prices for local products rising to €620-640/t compared to €620-630/t at the end of April and on May 24.

Demand in European markets did not contribute to a significant increase in prices due to the large number of holidays in early May. Producers noted that consumers are only interested in lower price levels, which puts pressure on the mills’ margins and leads to a loss of profits. The average lead times for orders at the beginning of the month were for delivery in June-July.

Buyers took a wait-and-see attitude. Given the weak order intake, service centers are refusing to purchase new batches of HRC. This indicates the start of a new phase of inventory reduction.

According to producers, the only way to solve the problem of low margins and prices is to cut production. Local factories are gradually preparing for such steps, but do not plan to shut down their facilities completely. Some of the service centers point out that they have not made a profit since the beginning of the year due to falling prices, and to become profitable, the price of HRC should be at least €40/t higher.

«European producers traditionally try to balance the market by cutting production. But as a rule, they do not succeed in this well – they are late in making decisions and, as a result, we see significant price fluctuations,» said Andriy Glushchenko, GMK Center analyst.

Import prices fluctuated at €600/t CFR in the ports of Northern and Southern Europe. At the same time, buyers complain about long delivery times. Turkey proved to be the most attractive supplier in terms of delivery time and prices (€610-620/t CFR Italy), but the quality of the products raises questions.

In North America, prices for hot-rolled coils have fallen sharply since the beginning of May, from $800-850/mt to $760-805/mt as of May 24. In the face of low demand, mills have to cut prices to remain competitive.

Market players are extremely cautious in their purchases due to economic uncertainty and a lull in the global steel market. Consumers are currently buying only limited volumes of products. At the same time, distributors point to a global problem of rising capacity utilization with a simultaneous drop in demand. Low demand is expected to weigh on the market at least until the end of the year.

In China, prices for hot-rolled plates have been stable since the end of April. During April 26-May 24, quotations remained at $550-555 per tonne.

Chinese prices have been unchanged for a long time amid weak apparent consumption. Although the authorities are stimulating the real estate sector, these steps do not affect spot prices, and create only small fluctuations in the futures market. Large volumes of HRC are only resold between distributors, while end-user demand is low. Export demand is also rather sluggish. The main sales go to Vietnam, although activity has slowed down significantly.