News Global Market flat & long steel prices 2059 18 April 2025

Market participants do not believe in the sustainability of the new benchmarks

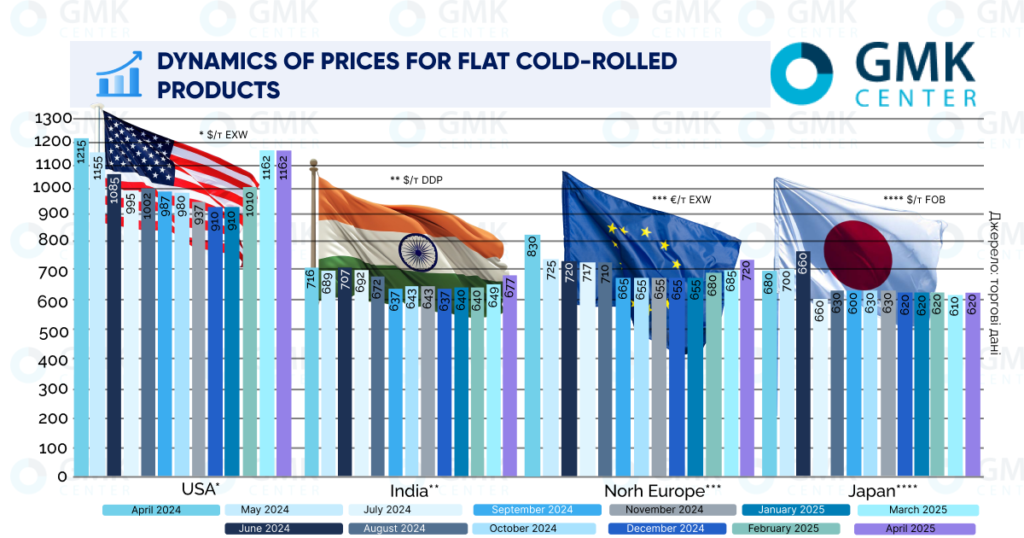

Prices for cold-rolled coils in the Nordic region rose by €10/t in the first half of April to €720/t EXW as of April 11. Representatives of metal service centers interviewed by Kallanish attribute this to the decision of the largest producer, ArcelorMittal, to raise the price by €20/t – to €700/t EXW for April deliveries.

Traders consider the price of €680/mt EXW to be more realistic for sales, as demand remains weak. Therefore, new offers from ArcelorMittal will push deals to the €680/t EXW horizon.

The price of cold rolled coil in the US remained unchanged in the first half of the month and remained at $1162/t EXW as of April 11. The timing of factory deliveries is stable, proving the steady demand. Which, however, has no upward trend.

In Japan, quotations for cold-rolled coils in the period from April 1 to April 11 were at $620/t FOB. This is due to the decision of the largest producer in Southeast Asia, the Chinese corporation Baosteel, not to raise prices for flat products, including for cold-rolled coils, for deliveries in May. Other local companies are looking to Baosteel in their market strategy.

Domestic prices for cold-rolled coils in India rose by $12/t to $677/t DDP from April 1 to 11. The increase in price offers was noted at the start of the new fiscal year (April 1), amid positive reports from automotive companies, the main consumers of these products.

For example, the largest Indian automaker Maruti Suzuki reported a 21% y/y increase in sales of its cars in March, up to 125.93 thousand units. In total, in FY 2024-2025, the company increased sales by 11%, to 1.256 million units.

However, the dynamics of car sales may slow down significantly in April. According to the Indian Federation of Automobile Dealers (FADA), 39% of auto traders expect a reduction in new car purchases this month. Another 43% believe that they will remain at the current level. This means that the potential for price growth for hot-rolled steel flat products will be exhausted.

Earlier it was reported that the Indian government is considering ways to protect the steel-using micro, small and medium-sized enterprises (MSMEs) sector from the impact of rising domestic prices in the event of a safeguard duty on imported steel products.