News Global Market Carbon prices 1541 03 April 2025

A decline in production volumes led to weak demand from the steel industry

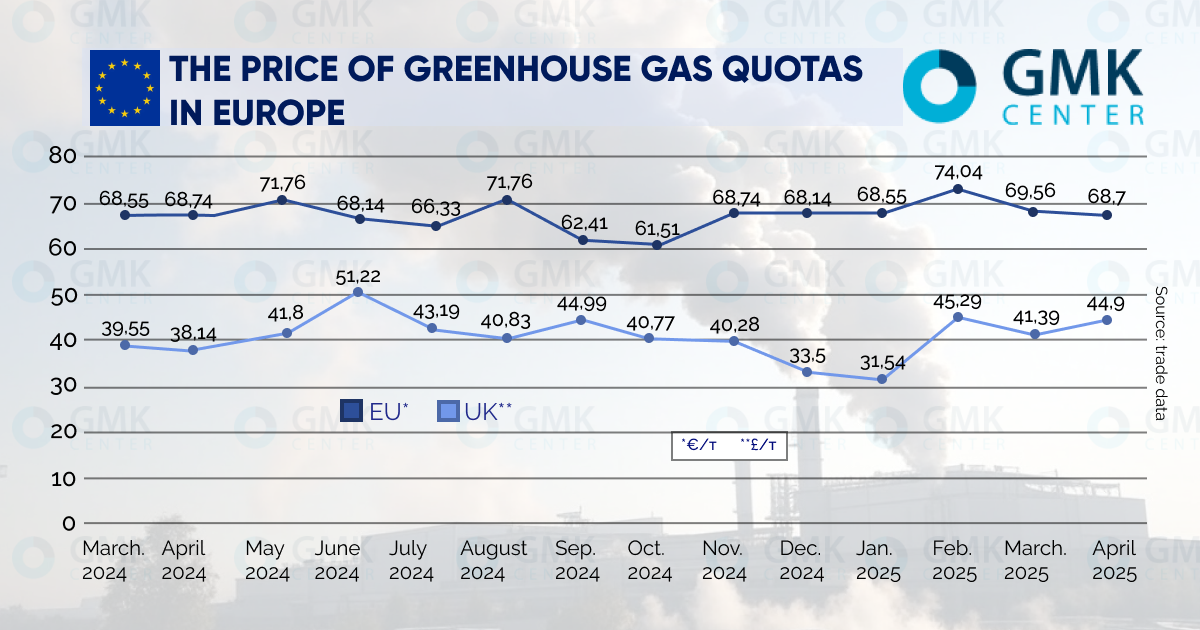

European CO2 emission permits (EUA) fell in price to €68.7/t by April 3, compared to €70.83/t on March 14, according to Trading Economics. Overall, the decline in March was €1.87/t, and €4/t for the quarter.

UK CO2 emissions futures on the London ICE exchange have lost £1.6/t since March 20, falling to £44.9/t on April 2. At the same time, since the beginning of March, the price has risen by £2.03/t, and by £8.52/t for the quarter. The government’s decision set the base cost of CO2 emissions in the UK for 2025 at £41.84/t.

The price reduction under the EU ETS was facilitated by weak demand from industry, primarily metallurgy. In January-February, steel production in the EU fell by 7.1%, to 20.4 million tonnes. In addition, concerns about the impact of US tariffs on the EU economy affected traders’ sentiment, putting pressure on the EUA price.

British metallurgy is also reducing emissions requests due to the internal crisis in the industry. At the end of March, a major manufacturer, British Steel, announced its intention to stop operating two blast furnaces at the Scunthorpe steel plant. Earlier, in September 2024, Indian Tata Steel announced plans to close two blast furnaces at the Port Talbot steel plant.

As reported, the European People’s Party called for a softening of the EU climate policy. In particular, it is proposed to cancel mandatory targets for reducing greenhouse emissions for industrial enterprises and simplify the administration of emissions reporting.