News Global Market coke production 1630 23 April 2025

Producers are trying to save margins amid rising prices for imported raw materials

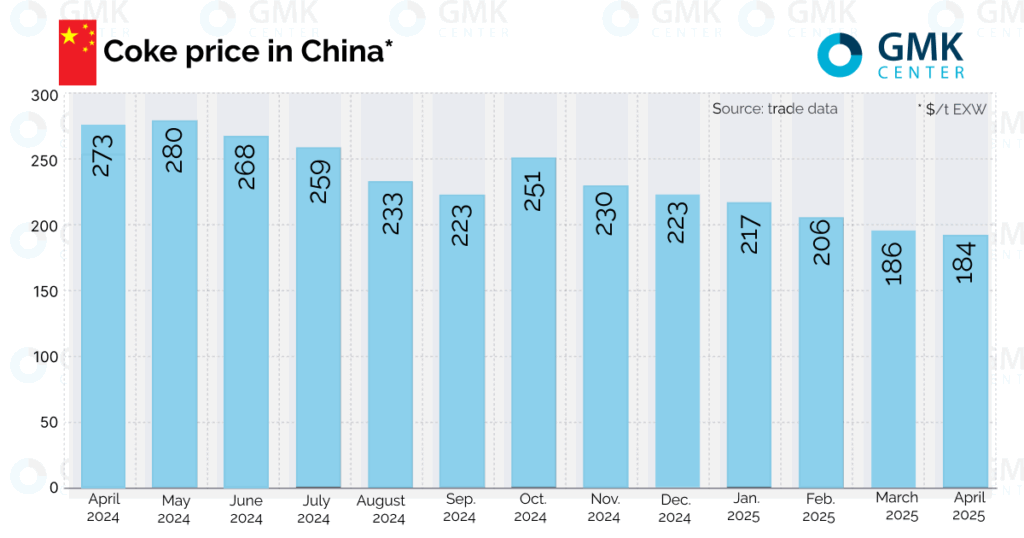

Quotes for Chinese coke in the port of Zhizhao rose by $1.4/t – to $184/t FOT between April 11 and 18, according to Kallanish. At the same time, this is $1.4/mt lower than at the beginning of the month.

As noted earlier, Australian export prices for premium coking coal increased by $14/t – to $181/t FOB in the first half of the month amid a situational reduction in supply. This puts pressure on the margins of China’s coke production, as prices for finished steel are declining.

In this situation, steel mills are refusing to purchase raw materials at higher prices. At the same time, Chinese mines are not reducing their demand for coke plants because their own stocks are low. In March, coke production in China fell by 4.1% y/y, which slowed the decline in prices in the middle of the month.

Indian coke prices remained stable at $404-410/t EXW in the first half of April. Overall, in Q1, the price increased by $46-52/t after the Indian government introduced quotas on duty-free imports. Supply offers from China and Indonesia in the middle of this month were in the range of $350/mt CFR, restraining further growth in domestic coke prices.

Higher price requests from local producers stimulate imports, despite additional duties. Thus, in March, coke imports to India increased by 138% m/m – to 232 thousand tons. The main volumes came from Poland.

In mid-April, the government set a precedent by allowing one of the largest steel producers, JSW Steel, to import 106 thousand tons of coke duty-free from Indonesia, which received a quota of 66.3 thousand tons for the first half of the year. Other companies are likely to follow JSW’s lead and appeal to the authorities with new similar requests.

Earlier, ArcelorMittal Nippon Steel India sent a letter to the Ministry of Commerce stating that restrictions on coke imports could hit steel production in the country and delay capacity expansion plans. According to AMNS India CEO Dilip Ummen, the circumstances are leading the company to shut down a blast furnace in June or reduce its utilization in April.