News Global Market coking coal prices 2110 25 March 2025

High warehouse stocks force producers to cut prices

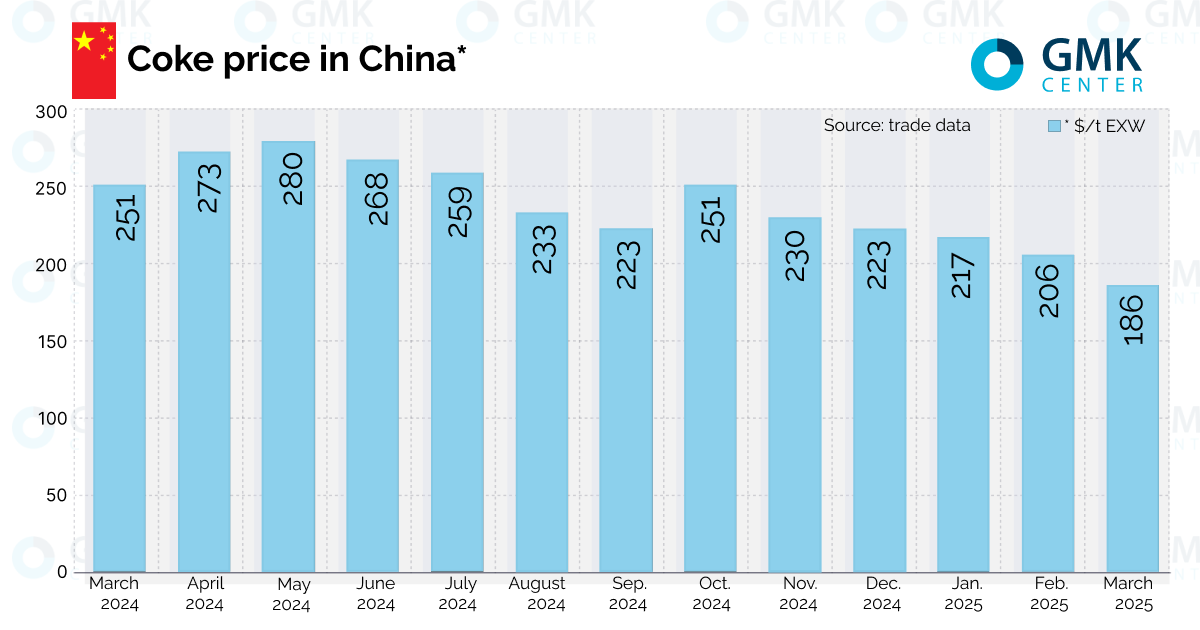

The cost of fine-grained grade I coke in the port of Rizhao fell by $4/t to $186/t EXW from March 7 to March 21, according to Kallanish. Since the beginning of the year, the price has decreased by $35/t.

Metalworks were cautious in purchasing amid uncertainty about the prospects for steel and pig iron production. In January-February, pig iron production in China decreased by 0.5% to 140.75 million tons, steel – by 1.5% to 166.3 million tons.

The price decline was also influenced by the decision of the authorities of the key coal mining region of Lülian (Shanxi Province) to stimulate the work of local state-owned mines. Previously, it was expected that they would reduce production by 8% in 2025. Continuing to subsidize allows state-owned mines not to reduce production. Thus, the provision of coke plants with raw materials will be maintained at last year’s level.

American prices for premium metallurgical coke 64% CSR by the beginning of March increased to $460/t EXW compared to $440/t EXW in January. Over the same period, the product in India rose in price from $310/t EXW to $320/t EXW. European prices fell from $340/t EXW to $330/t EXW.

The Business Research Company agency forecasts the growth of the global metallurgical coke market to $209.23 billion in 2025 compared to $200.66 billion in 2024. In 2029, the figure will reach $262.49 billion at an average annual rate of 5.8%. The forecast is based on the assumption that steel production will increase based on the growing demand for cars in the world.

As reported, metallurgical enterprises of Ukraine in January-February 2025 increased coke imports by 87.7%, to 155.93 thousand tons. The bulk of supplies are Polish products – 126.2 thousand tons. Another 27.7 thousand tons of coke were imported from Indonesia.