News Global Market coking coal prices 1402 06 May 2025

Coke plants increased inventories amid lower demand from steelmakers

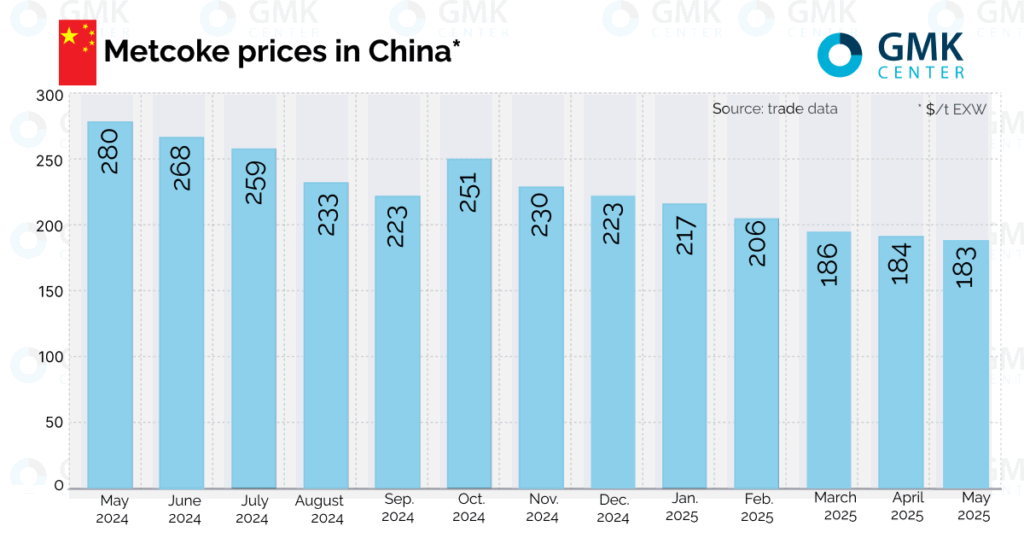

Grade I coke in the Chinese port of Zhizhao fell by $3/mt – to $183/mt EXW from April 25 to May 2, according to Kallanish. Quotes returned to the level they were in mid-April.

The decline in scrap prices allowed steelmakers to use it more actively in steelmaking. As a result, the consumption of pig iron, which requires coke, decreased. This allowed steel mills to reduce coke purchases. As a result, coke plants have increased their inventories. So they had to reduce their price requests.

The situation may change in May. The China Steel Logistics Committee (CSLC) predicts an improvement in demand for finished steel. The new orders index in April rose by 9.9% compared to March to 51%, according to a survey of purchasing managers of Chinese steel mills conducted by the CSLC.

At the same time, the finished steel inventory index decreased by 14.9% to 35.7%. This will support steelmaking capacity utilization in May and will require additional volumes of raw materials, including coke.

Indian premium coke prices fell by $5/t from April 25 to May 2 – to $399/t EXW. Pig iron during this period fell by $14/t to $397/t EXW. The decline in coke prices coincides with a drop in pig iron prices. Indian steel mills also preferred to use scrap for steelmaking.

As previously reported, in March 2025, China’s steelmakers increased steel production by 4.6% y/y – to 92.84 million tons. This is the highest figure for the last 10 months, according to the General Bureau of Statistics of China. Overall, in Q1 2025, steel production increased by 0.6% – to 259.33 million tons.