News Global Market Australia 460 02 July 2025

Large volumes from non-Australian suppliers appeared on the market

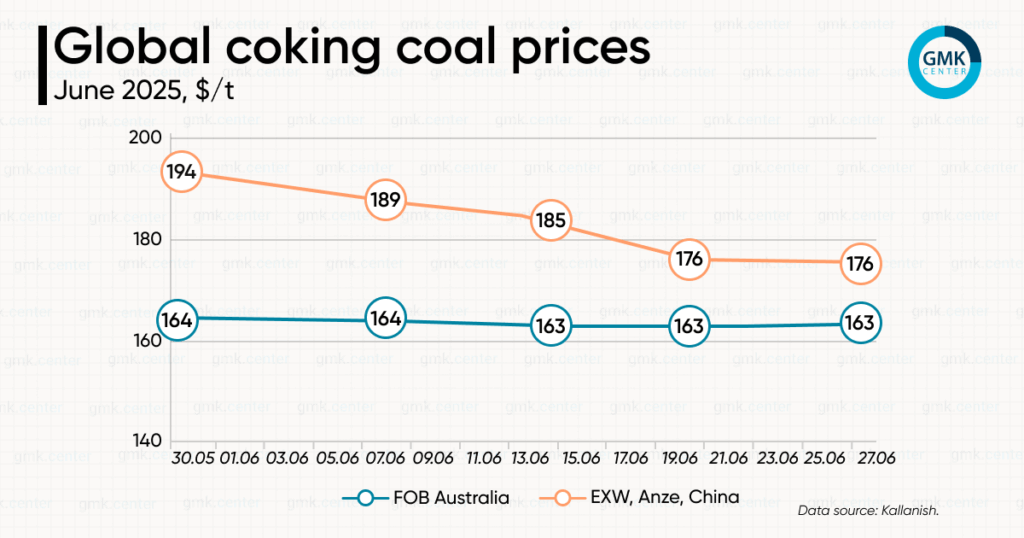

Quotations for seaborne coking coal fell last month – as of June 27, according to Kallanish, the FOB Australia price was $175.89/t, while as of May 30 it was $193.96/t.

Sentiment in the Asian seaborne coking coal market was pessimistic in June: low demand was accompanied by a loss of interest in Australian premium hard coking coal (PLV) amid the availability of affordable and competitive offers from other suppliers, particularly Canada, Indonesia, and China.

Demand from Indian buyers remained weak last month, including at the end of June, when an update to the metallurgical coke import policy was expected. In addition, non-Australian coal was also available to them at competitive prices.

On June 29, the Indian government extended restrictions on imports of low-ash metallurgical coke for six months (from July 1 to December 31). This move limits total imports to 1.4 million tons during the period and provides quotas for exporting countries.

In this way, the Indian government is encouraging steel companies to purchase coke locally. Large steel producers oppose the barriers, arguing that they restrict the supply of certain grades. Imports of low-ash metallurgical coke into the country have more than doubled in the last four years, with China, Japan, Indonesia, Poland, and Switzerland being the main suppliers.

The Chinese domestic coking coal market saw prices decline in June compared to May amid low demand and high inventory levels. This trend was observed despite a reduction in production due to safety and environmental inspections that affected coal mines in the north of the country.

However, at the end of the month, prices for this product stabilized and market sentiment improved, thanks in particular to reduced supplies from the Shanxi region and increased pig iron production by metallurgical plants. Nevertheless, sustained growth in prices is still considered unlikely.

Overall, according to Mysteel, China’s total coking coal stocks have been growing for two months in a row. However, between June 23 and 27, they began to decline significantly, mainly due to reduced production and improved sales of their products by mines. According to a survey of 523 mines, as of June 24, these reserves amounted to 11.47 million tons (-4.5% compared to the previous week).

According to Kallanish, spot prices for coking coal in China (EXW, Anze) as of June 27 were $163.16/ton.

It should be noted that Fitch Ratings, in its updated forecast, expects coking coal prices to remain stable over the next three years (2026-2028) at $180/t.

These expectations reflect the forecast for demand in China’s struggling steel sector, which will only be partially offset by new demand from blast furnace production in India and Southeast Asia. Risks to the price outlook for both coking and thermal coal are also linked to challenges for the global economy caused by US trade wars.

At the same time, Australia’s Department of Industry, Science and Resources predicts in its June report that Australian coking coal prices will remain around $200/t in 2026 and 2027, significantly below the average of $235/t in 2024. Exports of this product from the country in the 2024/2025 financial year (ending in June) are expected to decline to 147 million tons due to production disruptions, and will increase to 160 million tons in the 2025/2026 fiscal year and to 169 million tons in 2026/2027.

According to BigMint, global exports of coking coal in January-May 2025 decreased by 1.4% year-on-year to approximately 139 million tons.