News Global Market hot-rolled prices 2294 28 April 2025

Market sentiment stabilized after the excitement of the imported steel duties

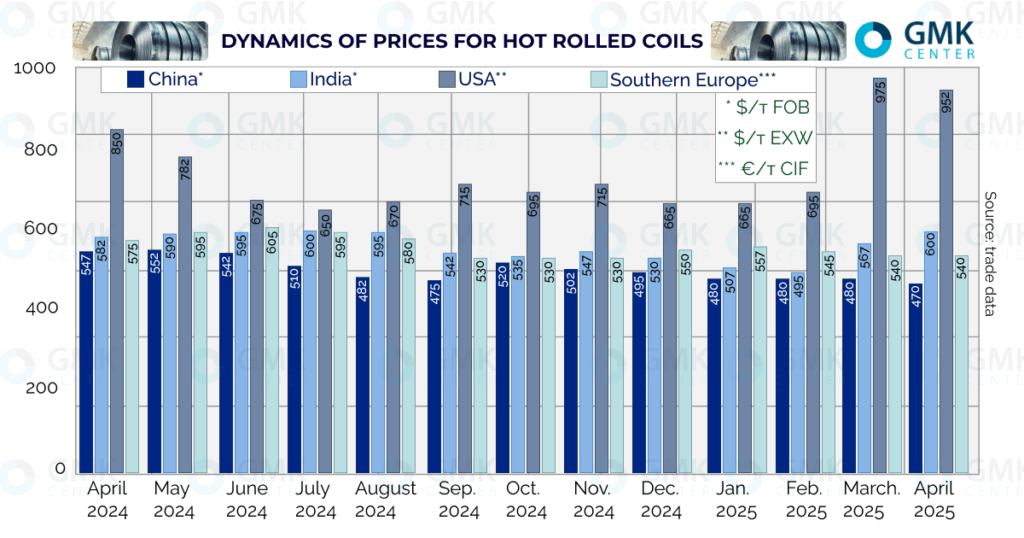

Offers from hot-rolled coil producers in the US dropped from $975/mt to $952/mt EXW from April 11-25, according to Kallanish. The previous values were peak due to the uncertainty that arose after the introduction of tariffs of 25% on imports of all steel products to the United States.

Earlier, traders noted that the $975/ton quotations do not reflect real demand, so they will be short-lived. Instead, requests from buyers remain stable, keeping prices from falling rapidly.

According to Cox Automotive, the US auto industry, the main consumer of hot rolled coils, will increase sales by 4.6% y/y in April – to 1.395 million units, but this figure will be 12% lower than in March 2025, despite the same number of trading days.

According to analysts, last month’s car sales were booming amid the introduction of a 25% duty on car imports to the United States. Currently, buyer sentiment in the car market has also stabilized.

An increase in purchases of rolled steel by automakers may be facilitated by a decline in the volume of cars in storage in March, from 3 million to 2.7 million units.

Indian hot-rolled coil prices rose by $8 in the second half of April, to $600/t FOB by April 25. Prices for all steel products in India showed growth in the first month of the new fiscal year, but this optimism may be corrected next month.

The cost of hot-rolled coils in the southern European region in the second half of the month decreased by €5 to €540/t CIF.

In the second half of April, Chinese prices for hot-rolled coils remained stable at $470/t FOB. The fall in prices in this segment has been ongoing since October 2024 and has probably reached the bottom. This is evidenced by the weekly rise in price of May futures for hot-rolled steel on the Shanghai exchange – by $7, to $446-449/t.

At the same time, traders do not expect a rebound in prices in the future. Contracts for the supply of hot-rolled coils in October were sold last week for $439/t. This is attributed to the fact that the Politburo of the CPC Central Committee did not make any important decisions for the economy at its meeting on April 25.

As reported, in March 2025, China’s metallurgical enterprises increased steel production by 4.6% y/y – to 92.84 million tons, according to the General Statistical Office of China. The figure was the highest in the last 10 months.