anti-dumping duties

News Global Market anti-dumping duties

12 November 2023

The restrictions will apply for the next 5 years

News Global Market Great Britain

31 August 2023

Government Decision Meets Local Trade Enforcement Authority (TRA) Guidelines

Opinions Industry anti-dumping duties

11 August 2023

It is expected that in the near future in Ukraine, two more lines will be added to the three existing rolled steel painting lines

Posts Industry anti-dumping duties

09 August 2023

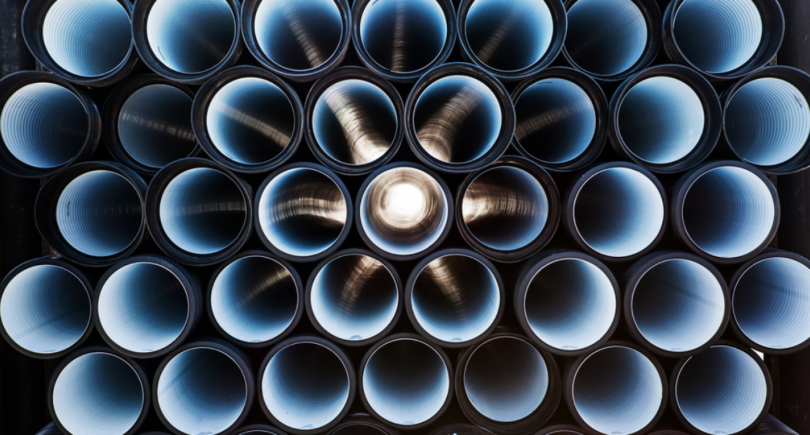

ICIT has established anti-dumping duties for coated rolled products, wire and pipes from China, as well as bars from Belarus

News State anti-dumping duties

03 August 2023

Anti-dumping measures are applied for a period of 5 years at a rate of 32.6% of the customs value of the goods

News State anti-dumping duties

02 August 2023

The initiator of the investigation was the ArcelorMittal Kryvyi Rih

News State anti-dumping duties

02 August 2023

The anti-dumping duty will be applied during the next 5 years in the amount of 30.7-48.14% of the customs value